TABLE OF CONTENT

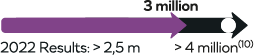

ÉVOLUTION CHANGE IN THE L’ORÉAL SHARE PRICE COMPARED TO THE CAC 40 INDEX FROM 31 DECEMBER 2012 TO 29 FEBRUARY 2024

This graph shows the evolution change in the L’Oréal share price compared to the CAC 40 Index from 31 December 2012 to 29 February 2024.

L’Oréal

- 12/2012: €104.90

- 02/2024: €441.70

CAC 40 indexed to L’Oréal

- 12/2012: €3,641.07

- 02/2024: €7,927.43

7.5.2.2. Total shareholder return

Amongst the various economic and financial indicators used to measure value creation, L’Oréal has chosen to apply the criterion of Total Shareholder Return: (TSR). This indicator is a synthetic measurement that takes into account not only the value of the share but also the dividend income received (excluding tax credits before 1 January 2005).

7.5.2.2.1. Five-year evolution of a portfolio of approximately €15,000 invested in L’Oréal shares with reinvestment of dividends

| Date of transaction | Nature of transaction | Investment (€) | Income (€) | Number of shares after the transaction |

|---|---|---|---|---|

| 31.12.2018 | 31.12.2018 Nature of transactionPurchase of 75 shares at €201.20 |

31.12.2018 Investment (€)15,090.00 |

31.12.2018 Income (€)

|

31.12.2018 Number of shares after the transaction75 |

| 30.04.2019 | 30.04.2019 Nature of transactionDividend: €3.85 per share |

30.04.2019 Investment (€)

|

30.04.2019 Income (€)288.75 |

30.04.2019 Number of shares after the transaction75 |

Nature of transaction Reinvestment: purchase of 2 shares at €245.10 |

Investment (€) 490.20 |

Income (€)

|

Number of shares after the transaction 77 |

|

| 07.07.2020 | 07.07.2020 Nature of transactionDividend: €3.85 per share |

07.07.2020 Investment (€)

|

07.07.2020 Income (€)296.45 |

07.07.2020 Number of shares after the transaction77 |

Nature of transactionReinvestment: purchase of 2 shares at €288.30 |

Investment (€) 576.60 |

Income (€)

|

Number of shares after the transaction 79 |

|

| 29.04.2021 | 29.04.2021 Nature of transactionDividend: €4.00 per share |

29.04.2021 Investment (€)

|

29.04.2021 Income (€)316.00 |

29.04.2021 Number of shares after the transaction79 |

Nature of transactionReinvestment: purchase of 1 share at €343.10 |

Investment (€) 343.10 |

Income (€)

|

Number of shares after the transaction 80 |

|

| 29.04.2022 | 29.04.2022 Nature of transactionDividend: €4.80 per share |

29.04.2022 Investment (€)

|

29.04.2022 Income (€)384.00 |

29.04.2022 Number of shares after the transaction80 |

Nature of transactionReinvestment: purchase of 2 shares at €348.90 |

Investment (€) 697.80 |

Income (€)

|

Number of shares after the transaction 82 |

|

| 28.04.2023 | 28.04.2023 Nature of transactionDividend: €6.00 per share |

28.04.2023 Investment (€)

|

28.04.2023 Income (€)492.00 |

28.04.2023 Number of shares after the transaction82 |

Nature of transaction Reinvestment: purchase of 2 shares at €432.75 |

Investment (€) 865.50 |

Income (€)

|

Number of shares after the transaction 84 |

|

| TOTAL AT 29.12.2023 | TOTAL AT 29.12.2023Nature of transaction18,063.20 | TOTAL AT 29.12.2023Investment (€)1,777.20 | TOTAL AT 29.12.2023Income (€)84 | |

| TOTAL NET INVESTMENT | TOTAL NET INVESTMENTNature of transaction16,286.00 | TOTAL NET INVESTMENTInvestment (€)

|

TOTAL NET INVESTMENTIncome (€)

|

|

Portfolio value at 31 December 2023 (84 shares at €450.65, price at 29 December 2023(1)The last trading day of 2023 is Friday, December 29, 2023.): €37,855.

The initial capital has thus been multiplied by 2.5 over 5 years (5‑year inflation rate = 12.12% – Source: INSEE) and the final capital is 2.3 times the total net investment.

The Total Shareholder Return of the investment is thus 19% per year (assuming that the shares are sold on 31 December 2023, excluding tax on capital gains).

NOTE: Any income tax that may be paid by the investor as a result of the successive dividend payments is not taken into account.

(1)The last trading day of 2023 is Friday, December 29, 2023.