TABLE OF CONTENT

Strategy

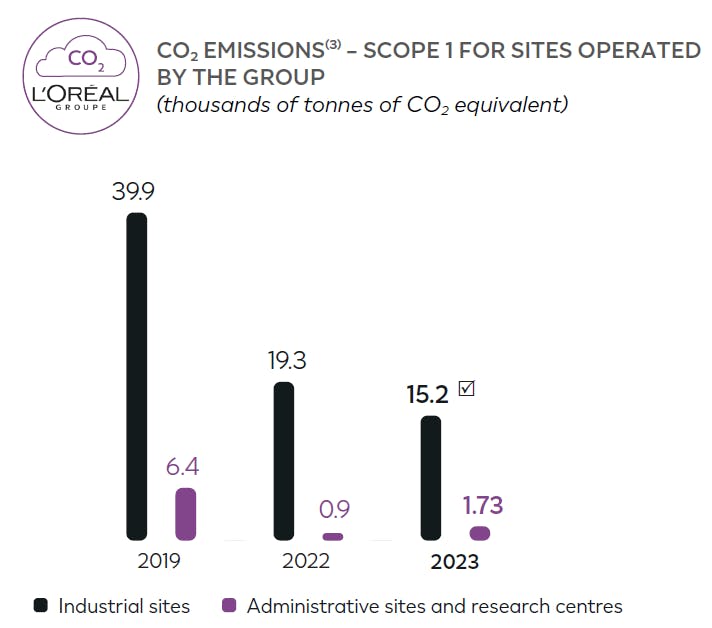

The concept behind the main environmental risks covers risks related to the impact of the Group’s business activities on its ecosystem and the risks of the impact of climate change in the short and medium-term on its business model, activity and financial performance.

The Group has identified four main risks and three opportunities relating to the physical and transition-related risks associated with climate change. These risks could have potential consequences on the value chain, business activities and the development of the Group’s strategy.

The in-depth analyses cover identifying these risks, approaching them proactively, evaluating their impacts using scenarios developed on two assumptions based on the 1.5°C and 3–4°C pathways, and integrating political, economic, social, technological, environmental and legal trends (PESTEL analysis).

Scenarios

These analyses were carried out according to the RCP 1.9 and RCP 8.5(1)Representative Concentration Pathways [RCP] – AR6 scenarios of the Intergovernmental Panel on Climate Change (IPCC) to identify and assess the physical and transitional risks associated with climate change.

- A “governed transition” scenario on the basis of global warming of +1.5°C by 2100 (scenario RCP 1.9). It is based on a structured transition and restrictive regulation, with strong international cooperation, major increased consumer awareness of climate and external effects and, globally, actions to anticipate and attenuate climate change in a more responsible and united world.

- A “disorganised transition” scenario on the basis of global warming of 3–4°C by 2100 (RCP 8.5 scenario). It is based on assumptions of limited international cooperation, growing tensions on trade, economic stagnation or slowdown, significant physical impacts and, generally, a primarily reactive adaptation to climate change.

Two timeframes were considered: a medium-term 2030 timeframe and a long-term 2050 timeframe with the aim of identifying impacts associated with climate assumptions at these dates.

Business experts from the Purchasing, Packaging, Logistics, Research & Innovation, Sustainability, Prospective and Consumer Studies teams were called on for this risks and opportunities analysis.

Studies have been conducted on the impact of the supply of plant-based raw materials on climate change.

Assumptions have been made on: carbon pricing trajectories, stakeholders expectations and consumer preferences. These assumptions represent the main exposure factors of L’Oréal to climate transition risks.

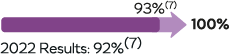

These works enable the Group to adapt its policies and define its strategic objectives in regard to the risks and opportunities associated with global warming. Notably, the results of this study and the action plans were presented to the Chief Corporate Responsibility Officer, the Chief Financial Officer and the Audit Committee.

Risks

The Group’s risk review includes physical risks and transition risks associated with Operations and changes in its value chain and ecosystem. Risks as diverse as those associated with extreme weather events on the Group’s infrastructures, or the risks inherent in the supply chain, those inherent in resource scarcity, carbon pricing (taxes, emissions trading schemes) and their financial impacts or those related to the Group’s reputation and consumer expectations are analysed. They lead to impact assessment procedures as part of the scenarios created and contribute to defining strategic orientations. The risk assessment showed that there is a predominance of transition risks over physical risks; therefore, these are presented first.

The following main risks and opportunities were studied.

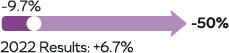

Risk 1: as a world leader in cosmetics, L’Oréal is dependent upon the availability of the materials used for its product packaging. The transition to a low-carbon economy is accompanied by developments in the design of more sustainable and innovative packaging and materials. Increased competition in the sustainable packaging materials market, resulting in a shortage of associated materials, could have an impact on L’Oréal. These factors may result in an increase in the average price of packaging materials and in production costs. We have already embarked upon long-term action plans to prevent and anticipate these risks (see subparagraph 4.3.1.3.1).

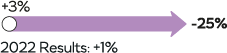

Risk 2: regulations concerning carbon pricing mechanisms (specific taxes on fossil fuels, carbon taxes, and emissions trading schemes) are a major challenge for the Group and its suppliers. In this context, an increase in the price per tonne of direct greenhouse gas emissions for suppliers could be reflected in the sale prices of their products and services and have an impact on L’Oréal’s operating costs. In order to mitigate this risk, the Group is working with its suppliers, in particular through CDP Supply Chain, to ensure they devise and implement emissions reduction targets and associated action plans (see paragraph 4.3.1.2).

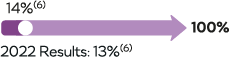

Risk 3: changes in consumer preferences towards consumption choices increasingly influenced by product carbon footprint and factory overall climate performance could have a material financial impact, progressively and in the medium-term, for L’Oréal. If this risk was insufficiently managed, the reduction in consumer demand could potentially have a negative impact on L’Oréal’s revenue. To prevent this risk, the Group’s strategy is to continue to reduce the carbon footprint of its products and enable consumers to make informed purchasing decisions. They will be informed in a way that is both transparent and responds to their expectations of the challenges of sustainability (see subparagraph 4.3.1.3.2). The study also took into account the more general assumptions associated with the company’s transformation as well as changes in consumer purchasing power, according to the scenarios considered.

(1) Representative Concentration Pathways [RCP] – AR6