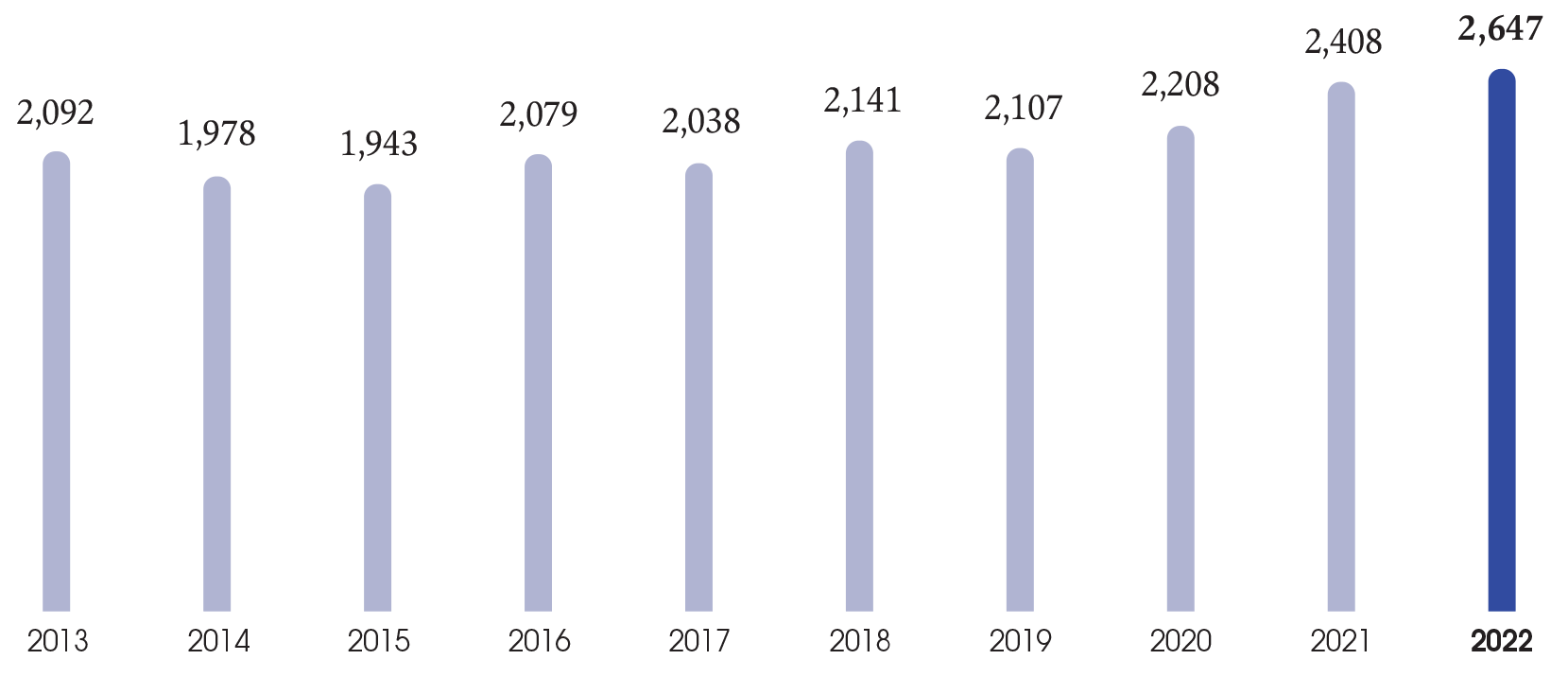

Change in the number of beneficiaries of ACAs since 2013

This graph shows the change in the number of beneficiaries of ACAs since 2013.

2013: 2,092

2014: 1,978

2015: 1,943

2016: 2,079

2017: 2,038

2018: 2,141

2019: 2,107

2020: 2,208

2021: 2,408

2022: 2,647

7.4.2. Absence of stock option plans for the subscription and purchase of shares of the Company

At 31 December 2022, there was no stock option plan in place for the purchase of Company shares(1), the last plan having expired in 2021.

7.4.3. Plan for the Conditional Grants of Shares (ACAs)

7.4.3.1. Authorisation of the Ordinary and Extraordinary General Meeting of 21 April 2022

The Annual General Meeting of 21 April 2022 gave the Board of Directors the authorisation to carry out free grants of existing shares and/or shares to be issued to employees, directors and corporate officers of the Company and of its French or foreign subsidiaries under the conditions of Article L. 225-197-2 of the French Commercial Code.

The Annual General Meeting set the period of validity of the authorisation, which may be used on one or more occasions, at 26 months.

The total number of free shares thus granted may not represent more than 0.6% of the share capital recorded on the date of the Board of Directors’ decision.

The number of free shares granted to the Company’s corporate officers may not represent more than 10% of the total number of free shares granted during a financial year pursuant to this resolution.

The Board of Directors will determine the identity of the beneficiaries of the free shares and the number granted to each of them. It will also determine the conditions to be met in order for the shares to fully vest, in particular the financial and non-financial performance conditions.

Financial and non-financial performance conditions

The financial performance criteria are based on:

- the growth in L’Oréal’s like-for-like cosmetics sales as compared to those of a panel of its biggest direct competitors(2); and

- growth in L’Oréal’s consolidated operating profit;

The non-financial performance criteria are based on:

- fulfilment of environmental and social responsibility commitments made by the Group as part of the L’Oréal for the Future programme (% of sites that are “carbon neutral”(3); % of formula ingredients that are biobased, traceable and come from sustainable sources; % of plastic packaging that comes from either recycled or biobased sources; number of people benefitting from the Group’s brands’ social commitment programmes); and

- gender balance within strategic positions including the Executive Committee.

The Board of Directors indeed considers that these two types of criteria, assessed over a long period of 3 financial years and applied to several plans, are complementary, in line with the Group’s objectives and its specificities and likely to promote balanced, continuing growth over the long term. They are exacting but remain a source of motivation for the beneficiaries. The grant of such shares to their beneficiaries, for all or part of the shares granted, will become final provided that the other conditions set at the time of grant are met, at the end of a minimum vesting period of 4 years.

(1) There are no plans for stock options in L’Oréal subsidiaries.

(2) The panel consists of the following companies: Unilever, Procter & Gamble, Estée Lauder, Shiseido, Beiersdorf, Johnson & Johnson, Henkel, LVMH, Kao and Coty.

(3) A site can claim “carbon neutral” status if it meets the following requirements:

- Direct CO2 (Scope 1) = 0, with the exception of: the gas used for catering, the fuel oil used for sprinkler tests, fossil energy consumptions during maintenance of on-site renewable facilities, cooling gas leaks if they are lower than 130 tonnes CO2eq./year; and

- Indirect CO2 Market Based (Scope 2) = 0. The renewable energy sources must be located on site or less than 500 kilometres from the site, and be connected to the same distribution network. The “carbon neutral” status, as defined above, is achieved without carbon offsetting. See section 4.3.1.1.3. B/.