We use cookies that are strictly necessary for the operation of this website as well as statistical cookies that allow us to anonymously know how users interact with the website in order to optimize your user experience.

These cookies can be set at any time from the publication.

TABLE OF CONTENT

- 1

- Prospects:...Prospects: Jean-Paul Agon, Chairman of the Board of Directors of L’OréalProspects: Jean-Paul Agon, Chairman of the Board of Directors of L’Oréal - Page 22

- Prospects: Nicolas...Prospects: Nicolas Hieronimus, Chief Executive Officer of L’OréalProspects: Nicolas Hieronimus, Chief Executive Officer of L’Oréal - Page 33

- Chapter 1...Chapter 1 : Presentation of the Group – Integrated ReportChapter 1 : Presentation of the Group – Integrated Report - Page 5

page 5 TO 52

- 1.1. The...61.1. The L’Oréal Group: the fundamentals1.1. The L’Oréal Group: the fundamentals - page6

- 1.2. L’Oréal,...141.2. L’Oréal, a value-creating model1.2. L’Oréal, a value-creating model - page14

- 1.3. 2022...361.3. 2022 Financial Results and Corporate Social Responsibility commitments1.3. 2022 Financial Results and Corporate Social Responsibility commitments - page36

- 1.4. A...501.4. A tailored, agile and responsive organisation1.4. A tailored, agile and responsive organisation - page50

- 1.5. Internal...511.5. Internal Control and risk management system1.5. Internal Control and risk management system - page51

- Chapter 2...Chapter 2 : Corporate governanceChapter 2 : Corporate governance - Page 53

page 53 TO 116

- 2.1. Framework...542.1. Framework for the implementation of corporate governance principles2.1. Framework for the implementation of corporate governance principles - page54

- 2.2. Composition...572.2. Composition of the Board at 31 December 20222.2. Composition of the Board at 31 December 2022 - page57

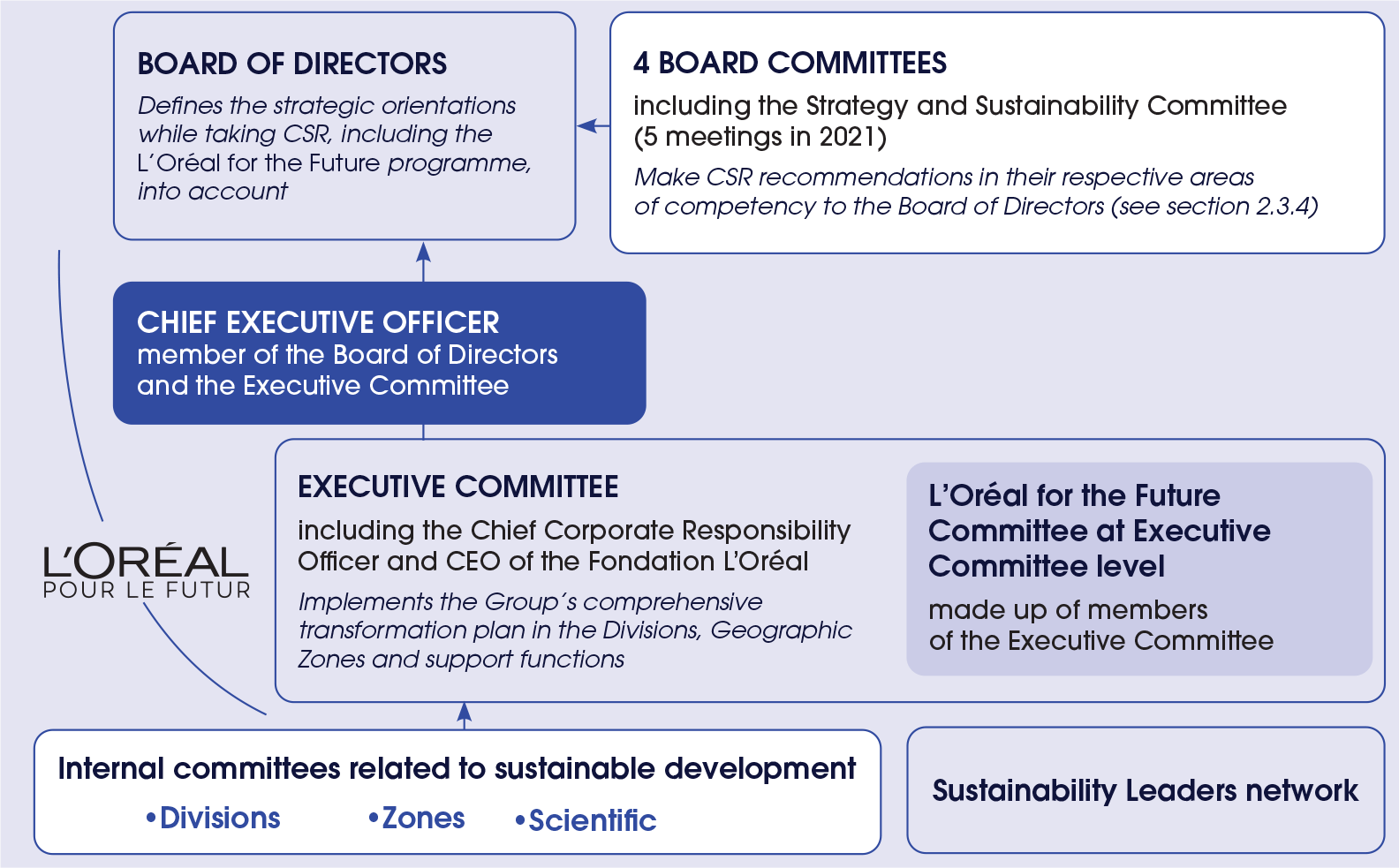

- 2.3. Organisation...722.3. Organisation and modus operandi of the Board of Directors2.3. Organisation and modus operandi of the Board of Directors - page72

- 2.4. Remuneration...912.4. Remuneration of directors and corporate officers2.4. Remuneration of directors and corporate officers - page91

- 2.5. Summary...1142.5. Summary table of the recommendations of the AFEP‑MEDEF Code which have not been applied2.5. Summary table of the recommendations of the AFEP‑MEDEF Code which have not been applied - page114

- 2.6. Summary...1152.6. Summary statement of trading by directors and corporate officers in L’Oréal shares in 20222.6. Summary statement of trading by directors and corporate officers in L’Oréal shares in 2022 - page115

- 2.7. Statutory...1152.7. Statutory Auditors’ Special Report on regulated agreements2.7. Statutory Auditors’ Special Report on regulated agreements - page115

- Chapter 3...Chapter 3 : Risk factors and risk managementChapter 3 : Risk factors and risk management - Page 117

page 117 TO 150

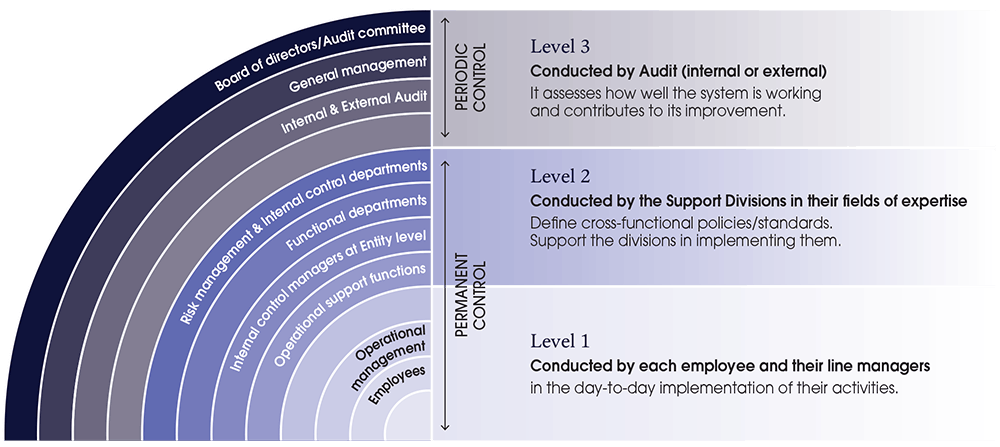

- 3.1. Definition...1183.1. Definition and objectives of Internal Control3.1. Definition and objectives of Internal Control - page118

- 3.2. Components...1193.2. Components of the Internal Control and Risk Management system3.2. Components of the Internal Control and Risk Management system - page119

- 3.3. Preparing...1243.3. Preparing and processing accounting and financial information3.3. Preparing and processing accounting and financial information - page124

- 3.4. Vigilance...1263.4. Vigilance Plan3.4. Vigilance Plan - page126

- 3.5. Risk...1413.5. Risk factors and risk management3.5. Risk factors and risk management - page141

- Chapter 4...Chapter 4 : Social, environmental and societal responsibilityChapter 4 : Social, environmental and societal responsibility - Page 151

page 151 TO 252

- 4.2. Main...1604.2. Main non-financial risks4.2. Main non-financial risks - page160

- 4.3. Policies,...1624.3. Policies, performance indicators and results4.3. Policies, performance indicators and results - page162

- 4.4. L’Oréal...2314.4. L’Oréal for the Future: 2022 results4.4. L’Oréal for the Future: 2022 results - page231

- 4.5. Methodological...2324.5. Methodological notes4.5. Methodological notes - page232

- 4.6....2394.6. Cross-reference tables, including NFIS and GHG balance4.6. Cross-reference tables, including NFIS and GHG balance - page239

- 4.7. Statutory...2444.7. Statutory Auditor's Reports4.7. Statutory Auditor's Reports - page244

- Chapter 5...Chapter 5 : 2022 Consolidated Financial StatementsChapter 5 : 2022 Consolidated Financial Statements - Page 253

page 253 TO 316

- 5.1. Compared...2545.1. Compared Consolidated Income Statements5.1. Compared Consolidated Income Statements - page254

- 5.2. Consolidated...2555.2. Consolidated Statement of Comprehensive Income5.2. Consolidated Statement of Comprehensive Income - page255

- 5.3. Compared...2565.3. Compared Consolidated Balance Sheets5.3. Compared Consolidated Balance Sheets - page256

- 5.4. Consolidated...2575.4. Consolidated Statements of Changes in Equity5.4. Consolidated Statements of Changes in Equity - page257

- 5.5. Compared...2595.5. Compared Consolidated Statements of Cash Flows5.5. Compared Consolidated Statements of Cash Flows - page259

- 5.6. Notes...2605.6. Notes to the Consolidated Financial Statements5.6. Notes to the Consolidated Financial Statements - page260

- 5.7. Main...3105.7. Main consolidated companies at 31 December 20225.7. Main consolidated companies at 31 December 2022 - page310

- 5.8. Statutory...3135.8. Statutory Auditor's Report on the Consolidated Financial Statements5.8. Statutory Auditor's Report on the Consolidated Financial Statements - page313

- Chapter 6...Chapter 6 : Parent company financial statementsChapter 6 : Parent company financial statements - Page 317

page 317 TO 344

- 6.1. Compared...3186.1. Compared income statements6.1. Compared income statements - page318

- 6.2. Compared...3196.2. Compared balance sheets6.2. Compared balance sheets - page319

- 6.3. Changes...3206.3. Changes in shareholders’ equity6.3. Changes in shareholders’ equity - page320

- 6.4. Statements...3216.4. Statements of cash flows6.4. Statements of cash flows - page321

- 6.5. Notes...3226.5. Notes to the financial statements of L’Oréal S.A.6.5. Notes to the financial statements of L’Oréal S.A. - page322

- 6.6. Other...3376.6. Other information relating to the financial statements of L’Oréal S.A.6.6. Other information relating to the financial statements of L’Oréal S.A. - page337

- 6.7....3386.7. Five-year financial summary6.7. Five-year financial summary - page338

- 6.8. Equity...3396.8. Equity investments (main changes including shareholding threshold changes)6.8. Equity investments (main changes including shareholding threshold changes) - page339

- 6.9. Statutory...3406.9. Statutory Auditor's Report on the Financial Statements6.9. Statutory Auditor's Report on the Financial Statements - page340

- Chapter 7...Chapter 7 : Share capital and stock market informationChapter 7 : Share capital and stock market information - Page 345

page 345 TO 364

- 7.1. Information...3467.1. Information relating to the Company7.1. Information relating to the Company - page346

- 7.2. Information...3487.2. Information concerning the share capital7.2. Information concerning the share capital - page348

- 7.3. Shareholder...3507.3. Shareholder structure7.3. Shareholder structure - page350

- 7.4....3537.4. Long-term incentive plans7.4. Long-term incentive plans - page353

- 7.5. The...3587.5. The L’Oréal share/the share market7.5. The L’Oréal share/the share market - page358

- 7.6. Information...3637.6. Information and shareholder dialogue policy7.6. Information and shareholder dialogue policy - page363

- Chapter 8...Chapter 8 : Annual General MeetingChapter 8 : Annual General Meeting - Page 365

page 365 TO 386

- 8.1. Draft resolutions and Report of the Board of...3668.1. Draft resolutions and Report of the Board of Directors to the Ordinary and Extraordinary General Meeting to be held on Friday 21 April 20238.1. Draft resolutions and Report of the Board of Directors to the Ordinary and Extraordinary General Meeting to be held on Friday 21 April 2023 - page366

- 8.2. Statutory...3858.2. Statutory Auditor's Report8.2. Statutory Auditor's Report - page385

- 9.1. Statutory...3889.1. Statutory Auditors9.1. Statutory Auditors - page388

- 9.2. Historical...3889.2. Historical financial information included by reference9.2. Historical financial information included by reference - page388

- 9.3. Declaration...3889.3. Declaration by the person responsible for the Universal Registration Document and the Annual Financial Report9.3. Declaration by the person responsible for the Universal Registration Document and the Annual Financial Report - page388

- 9.4....3899.4. Cross-reference table with the Universal Registration Document9.4. Cross-reference table with the Universal Registration Document - page389

- 9.5. Annual...3919.5. Annual Financial Report cross-reference table9.5. Annual Financial Report cross-reference table - page391

- 9.6....3919.6. Cross-reference table with the AMF tables on the remuneration of directors and corporate officers9.6. Cross-reference table with the AMF tables on the remuneration of directors and corporate officers - page391

- 9.7. Management...3929.7. Management Report cross-reference table9.7. Management Report cross-reference table - page392

NOTE 13. Sustainable development and the climate

13.1. Measurement of assets and liabilities

a) Environmental risks

The Group strictly complies with regulations and laws relating to environmental protection, and does not expect current regulations to have any significant impact on the Group’s operations, financial position, earnings or assets.

b) Measurement of assets

For many years, L’Oréal has shown a strong commitment to environmental, social and societal responsibility. L’Oréal placed sustainability at the heart of its strategy, with the launch in 2013 of the Sharing Beauty With All programme with 2020 targets focused on sustainable production, sustainable innovation, sustainable consumption and shared growth.

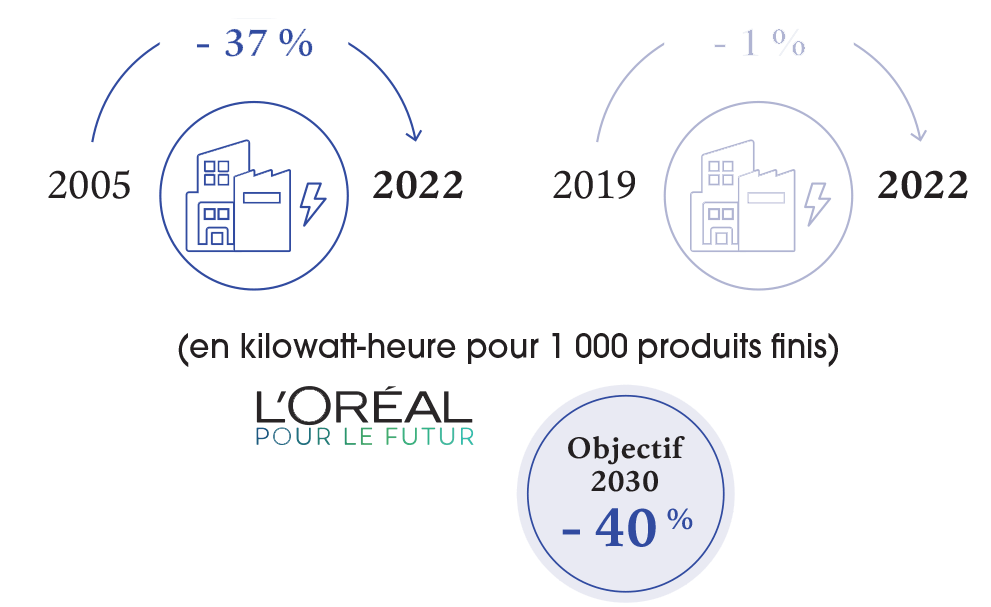

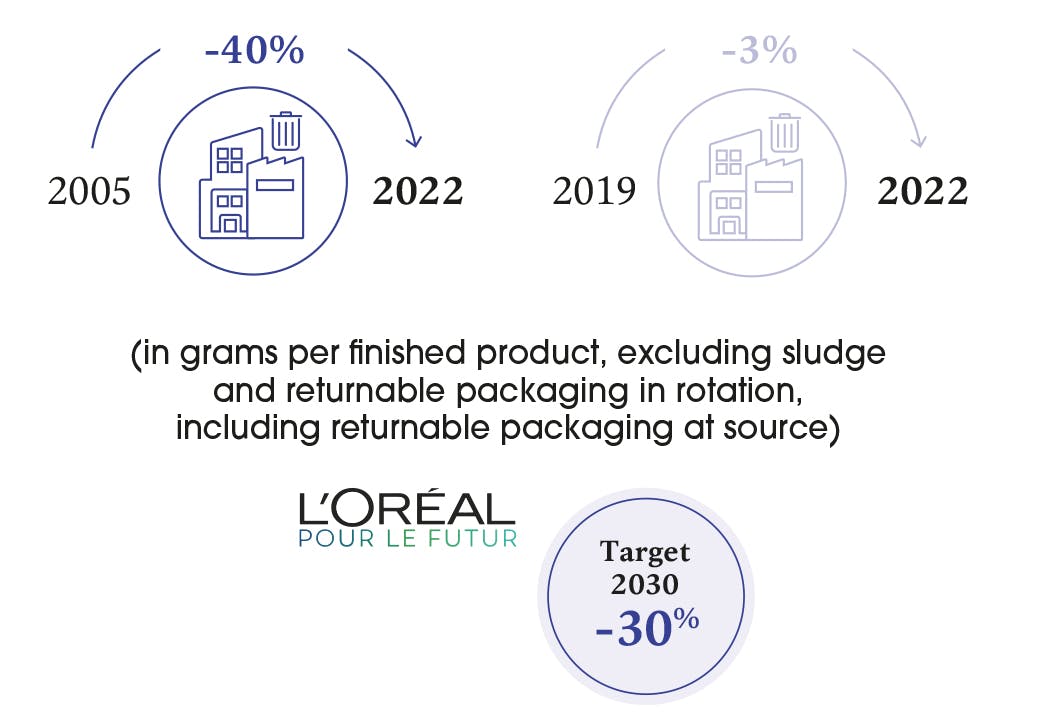

In June 2020, L’Oréal initiated the second phase of its commitments to sustainable development, under the umbrella of the L’Oréal for the Future programme, with a new set of particularly ambitious and concrete targets for 2030, in order to cover all the impacts associated with its value chain: its production and distribution sites as well as its supply chains and the impacts associated with the use of products by consumers.

For example:

- the Group undertakes to reach "carbon neutrality(1)" for all Group sites by 2025, by improving energy efficiency and using 100% renewable energy;

- by 2030, 100% of ingredients in formulas and biobased packaging materials will be traceable and come from sustainable sources. None of them will contribute to deforestation;

- by 2030, 100% of the plastics used in packaging will be from either recycled or biobased sources;

- by 2030, L’Oréal undertakes to innovate to enable its consumers to reduce by 25%, on average and per finished product, the water consumption and greenhouse gas emissions linked to the use of its products, compared to 2016.

The above commitments do not jeopardise the value of the Group’s assets or the useful lives of our non-financial assets.

In particular:

- our ongoing efforts to bring our products in line with consumer demand as part of L’Oréal for the Future are included in the Group’s short-term strategic plans used in impairment tests on intangible assets with an indefinite useful life;

- to date, the adaptation of our plants and product formulas has not led us to identify any risk of our production lines becoming obsolete or experiencing a reduction in their value in use.

13.2. Financing, investments and compensation

The Group’s L’Oréal for the Future programme rests on its financing, short- and long-term investment and compensation strategies.

a) Financing

The credit lines indexed to the Group's sustainable development performance incorporate a borrowing cost adjustment mechanism.

The L’Oréal Group has a syndicated loan from 19 banks (€5 billion), which had not been used at the end of December 2022. This loan incorporates a mechanism whereby the margin is adjusted in line with the Group’s performance with regard to four ESG KPIs: climate, biodiversity, resources and social commitment.

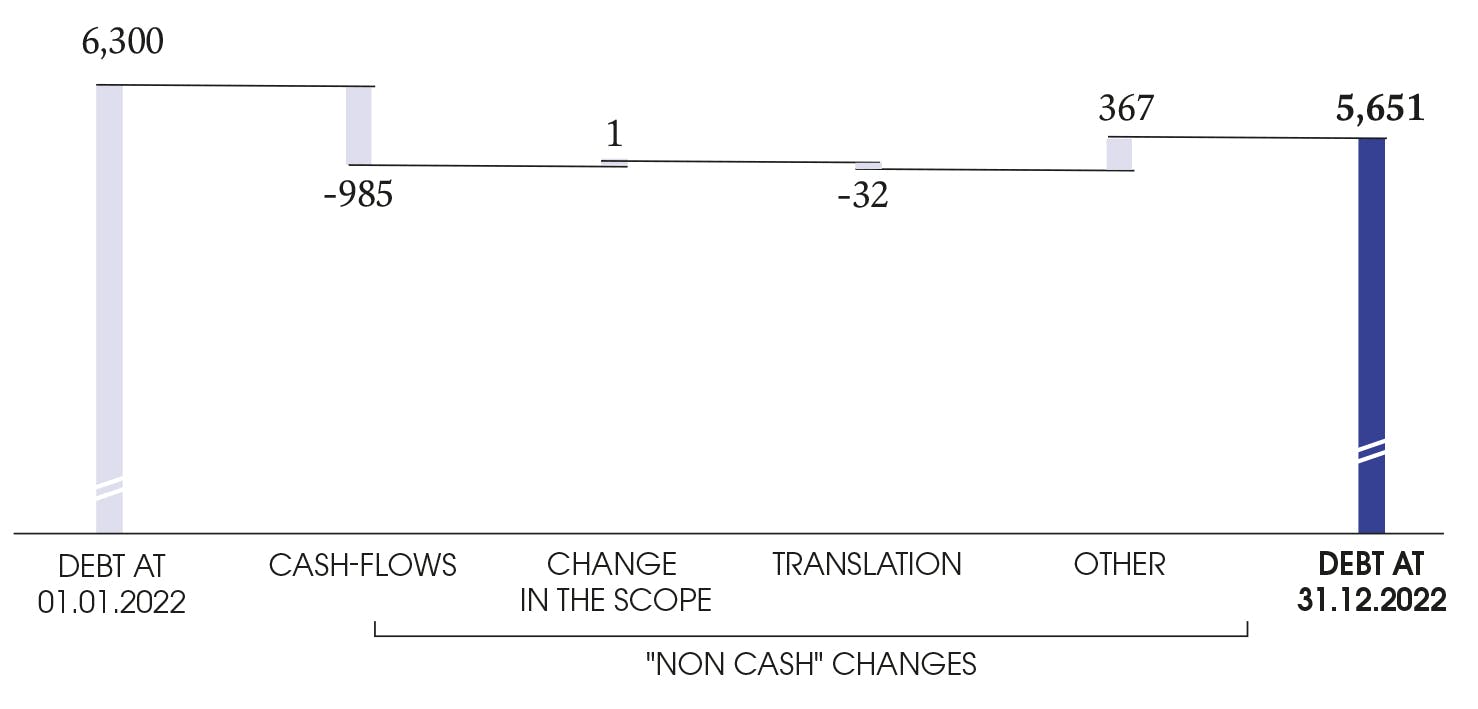

The Group issued a €3 billion bond in three tranches, one of which a €1,250 million 4.25-year fixed rate Sustainability-Linked Bond included environmental (ESG) criteria linked to the Group's CSR performance (note 9.1).

b) Short-term investment

The Group's available cash is mainly invested in SRI SICAV money-market funds (40% of all short-term investment in 2022) and term accounts (60% of all short-term investment in 2022).

c) Long-term investment

The Group recorded a total of €157 million in non-current financial assets related to sustainable development activities, measured at fair value through equity (note 9.3).

- at the end of 2021, investment in Circular Innovation Fund amounting to €50 million. L'Oréal is one of the main contributors to this impact investing fund, whose investment thesis is focused on seven verticals including new packaging materials and solution from bioeconomy and the circular economy, green technology and waste and recycling collection services.

- in 2020, the creation of a fund for Nature Regeneration to financially support projects to restore natural marine, forest and agricultural ecosystems. This dedicated €60 million fund had already invested in three projects at the end of 2022.

- investment in start-ups (€42 million in total), including the Swiss environmental technology firm Gjosa, which developed innovative water saving solutions, the French biotech company Global Bio energies, which developed a process to convert plant-based resources, the green chemistry start-up Carbios, which developed enzymatic processes for plastic biodegradation and biorecycling and the French biotech Microphyt which developped a process with a low carbon impact to produce microalgae.

(1) A site can claim "carbon neutral" status if it meets the following requirements:

- - Direct CO2 (Scope 1) = 0, with the exception of: the gas used for catering, the fuel oil used for sprinkler tests, fossil energy consumptions during maintenance of on-site renewable facilities, cooling gas leaks if they are lower than 130 tonnes CO2eq./year; and

- - Indirect CO2 Market Based (Scope 2) = 0. The renewable energy sources must be located on site or less than 500 kilometres from the site, and be connected to the same distribution network. The "carbon neutral" status, as defined above, is achieved without carbon offsetting.