First quarter 2017 sales

in a temporarily atypical market

Sales: 7.04 billion euros

- +7.5% based on reported figures

- +5.1% at constant exchange rates

- +4.2% like-for-like1

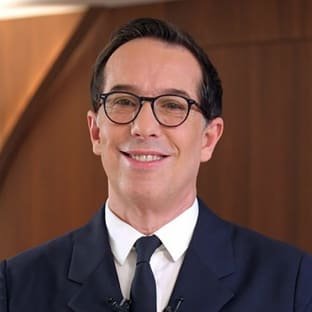

Commenting on the figures, Mr Jean-Paul Agon, Chairman and Chief Executive Officer of L'Oréal, said:

"The cosmetics market has unexpectedly proven extremely atypical in the first weeks of the year, with very strong consumption of luxury products, especially in Asia, and, on the contrary, a very slow start for consumption in the mass-market and the professional market. The market seems to have become steadier and is returning to a more usual profile.

In this context, the Group delivered a good first quarter, up by +7.5% based on reported figures and +4.2% like-for-like. Performance levels are consequently very differentiated across the Divisions, with outstanding growth for L'Oréal Luxe, a satisfactory start for Active Cosmetics, moderate growth for Consumer Products despite market share gains, and a slight drop for Professional Products.

Across the geographic Zones, sales in Western Europe are continuing to hold up well, despite a disappointing market in France, thanks to outstanding growth rates in the United Kingdom, Germany and Spain. North America is continuing to prove dynamic. Lastly, the New Markets delivered a solid performance, particularly in Eastern Europe and Asia; Brazil remains difficult and the Middle East is affected by the downturn of the markets.

The Group is continuing its acceleration in digital, both in marketing and in e-commerce2, which posted +27% growth during the quarter and accounted for 6.8% of total sales.

Finally, the acquisition of CeraVe complements the Active Cosmetics brand portfolio in the strongly expanding segment of accessible dermocosmetics, and will amplify this Division's growth potential.

In an environment that remains volatile, our well-balanced business model is now more than ever an asset. We are confident in our ability to achieve another year of sales and profit growth in 2017."

First quarter 2017 sales

Like-for-like, i.e. based on a comparable structure and identical exchange rates, the sales growth of the L'Oréal Group was +4.2%.

The net impact of changes in consolidation was +0.9%.

Growth at constant exchange rates was +5.1%.

Currency fluctuations had a positive impact of +2.4%. If end of March exchange rates (€1 at $1.068) are extrapolated up to 31 December, the impact of currency fluctuations would be +2.4% for the whole of 2017.

Based on reported figures, the Group's sales at 31 March 2017 amounted to 7.04 billion euros, an increase of +7.5%.

Sales by Operational Division and Geographic Zone

| Quarterly sales | Growth | ||||

| € million | 1st quarter 2016 | 1st quarter 2017 | Like-for-like | Reported | |

| By Operational Division | |||||

| Professional Products | 854.3 | 858.2 | -1.8% | 0.5% | |

| Consumer Products | 3,106.0 | 3,229.2 | 1.4% | 4.0% | |

| L'Oréal Luxe | 1,831.4 | 2,157.1 | 12.2% | 17.8% | |

| Active Cosmetics | 560.7 | 603.2 | 2.8% | 7.6% | |

| Operational Divisions total | 6,352.4 | 6,847.8 | 4.2% | 7.8% | |

| By Geographic Zone | |||||

| Western Europe3 | 2,102.9 | 2,136.6 | 2.8% | 1.6% | |

| North America | 1,715.9 | 1,917.0 | 3.8% | 11.7% | |

| New Markets, of which: | 2,533.5 | 2,794.2 | 5.6% | 10.3% | |

| - Asia, Pacific3 | 1,535.0 | 1,671.4 | 7.1% | 8.9% | |

| - Latin America | 409.0 | 474.7 | 4.6% | 16.1% | |

| - Eastern Europe | 390.6 | 481.5 | 12.7% | 23.2% | |

| - Africa, Middle East | 198.9 | 166.5 | -18.8% | -16.3% | |

| Operational Divisions total | 6,352.4 | 6,847.8 | 4.2% | 7.8% | |

| The Body Shop | 200.1 | 197.2 | 2.3% | -1.4% | |

| Group total | 6,552.4 | 7,045.0 | 4.2% | 7.5% | |

PROFESSIONAL PRODUCTS

At the end of March, the Professional Products Division posted -1.8% like-for-like and +0.5% based on reported figures.

The Division's sales have contracted slightly, with sharp contrasts in performances across the geographic Zones. Western Europe has been severely affected by the difficulties of the French market. The United States remain difficult, while Eastern Europe and Latin America are continuing to grow.

L'Oréal Professionnel, Redken and Matrix are gradually rolling out their new "bonders4" salon service. In haircare, Kérastase is launching Aura Botanica, and Matrix is internationalising Biolage R.A.W., and both these ranges cater for the growing trend of naturalness. In skincare, Decléor is maintaining its momentum.

CONSUMER PRODUCTS

In the first quarter, the Consumer Products Division recorded growth of +1.4% like-for-like, and +4.0% based on reported figures.

Against the backdrop of a less dynamic than expected market in the first weeks of the year, the Division is winning market share in most regions of the world, thanks to its successful launches. This outperformance is particularly striking in Western Europe and North America.

Make-up is continuing to grow, thanks to a very good range of innovations, including False Lash Superstar X-Fiber mascara by L'Oréal Paris, the Master Camo colour correcting palette by Maybelline and Total Control Drop foundation by NYX Professional Makeup. Colorista, the hair colour for Millennials5 by L'Oréal Paris is already a major success. In haircare, the roll-out of Ultra Doux by Garnier is continuing, and the launch of Botanicals Fresh Care by L'Oréal Paris is extending the Division's offering in the expanding naturalness segment.

L'ORÉAL LUXE

In a dynamic selective market, L'Oréal Luxe made an outstanding start to the year, driven by make-up, with growth of +12.2% like-for-like and +17.8% based on reported figures.

This success is driven by: Yves Saint Laurent, thanks to its make-up, particularly with the launch of Volupté Tint-in-Balm in the lip segment, and to the success of its fragrance Mon Paris with American and Asian customers; Lancôme, with its star foundation Teint Idole Ultra, its lipstick L'Absolu Rouge and its emblematic skincare line Génifique; Giorgio Armani, with the recent launches of Lip Magnet and the Power Fabric foundation. Urban Decay and Kiehl's are posting double-digit growth. The two brands acquired in 2016 - IT Cosmetics in make-up and skincare, and Atelier Cologne in fragrances - are also expanding very quickly.

Sales have made a good start in the Asia, Pacific Zone, particularly in China. Western Europe had a very good quarter, driven by the United Kingdom and Spain. L'Oréal Luxe delivered a solid performance at the start of the year in North America and in the Travel Retail channel. In the Middle East, the Division is proving resilient to the market slowdown. L'Oréal Luxe is continuing to perform well in e-commerce.

ACTIVE COSMETICS

At the end of March, the Active Cosmetics Division continued to grow, at +7.6% based on reported figures and +2.8% like-for-like.

La Roche-Posay remains dynamic, driven by the renewal of its Lipikar range and the success of its Effaclar and Toleriane lines. SkinCeuticals has made an excellent start to the year, with double-digit growth in Europe, Asia and the Americas, boosted by the success of its new launch H.A. Intensifier.

North America has recorded particularly strong double-digit growth at the end of March, with strong momentum for all brands, and is strengthening its presence with the acquisition of CeraVe, finalised in early March.

Multi-division summary by geographic Zone

WESTERN EUROPE

First-quarter growth amounted to +2.8% like-for-like and +1.6% based on reported figures. Growth is particularly strong in the United Kingdom, Spain and Germany, but sales in France are still being held back by a market that remains difficult. The Consumer Products and L'Oréal Luxe Divisions are significantly outperforming their respective markets.

NORTH AMERICA

The Zone reported growth of +3.8% like-for-like and +11.7% based on reported figures. The strategic acquisition of CeraVe strengthens the brand portfolio and the positions of the Active Cosmetics Division. L'Oréal Luxe gained share within a changing retail environment driven by IT Cosmetics, Urban Decay and Yves Saint Laurent. The Consumer Products Division continues to capture growth and gain shares with a particularly strong development of the NYX Professional Makeup, Garnier, and Carol's Daughter brands.

NEW MARKETS

Asia, Pacific: the Zone is growing by +7.1% like-for-like and +8.9% based on reported figures. In Northern Asia, Hong Kong has returned to dynamic growth, thanks to L'Oréal Luxe whose strong growth is spreading to all the Northern countries, with the performances of the Lancôme, Yves Saint Laurent and Giorgio Armani brands. In Southern Asia, growth remains dynamic, driven by Australia, Thailand and Indonesia, where the Consumer Products Division is posting good results thanks to the Garnier and NYX Professional Makeup brands.

Latin America: the Zone reported growth of +4.6% like-for-like and +16.1% based on reported figures. Mexico, Argentina and Uruguay reported double-digit growth, driven by the strong performance of the Consumer Products Division make-up brands NYX Professional Makeup, Maybelline, Vogue and L'Oréal Paris. SkinCeuticals, Vichy and La Roche-Posay all contributed to the growth of Active Cosmetics. In Brazil, the market remains challenging.

Eastern Europe: the Zone reported growth of +12.7% like-for-like and +23.2% in reported figures. Growth was positive in all countries in this Zone, with strong growth in Russia, Poland and Turkey. All the Divisions are contributing to growth, particularly L'Oréal Luxe thanks to Urban Decay and Yves Saint Laurent make-up. The Consumer Products Division is winning market share in make-up and hair colour, thanks to Magic Retouch by L'Oréal Paris. Lastly, the Professional Products Division is growing with Smart Bond by L'Oréal Professionnel and the continuing dynamism of Matrix.

Africa, Middle East: sales are down at -18.8% like-for-like and -16.3% based on reported figures. The market in Saudi Arabia is slowing, creating distributors' inventory adjustments. Growth is continuing in Pakistan and Egypt.

THE BODY SHOP

The Body Shop recorded growth of +2.3% like-for-like and -1.4% based on reported figures. The United Kingdom, Canada and Indonesia grew robustly and Hong Kong showed signs of recovery. Saudi Arabia remains challenging. Skincare continues to grow strongly, boosted by the launch of an innovative range of Peel skin cleansers and the success of Recipes of Nature masks.

Important events during the period 1/1/17 to 31/3/17

- On 10 January, L'Oréal announced the signing of a definitive agreement with Valeant to acquire the brands CeraVe, AcneFree and Ambi. The acquisition of these brands completes and strengthens the Active Cosmetics Division's positions in the United States, enabling it to meet growing demand for active skincare products at accessible prices. The acquisition was finalised on 6 March 2017.

- In its news release of 9 February, the Group states that it has decided to explore all strategic options regarding The Body Shop's ownership in order to give it the best opportunities and full ability to continue its development. No decision has been taken so far.

- Between 13 February and 15 March, L'Oréal bought back 2,846,604 of its shares in order to cancel them, in accordance with the authorisation voted by the Annual General Meeting of 20 April 2016, and with the decision of the Board of Directors on 9 February 2017.

"This news release does not constitute an offer to sell, or a solicitation of an offer to buy L'Oréal shares. If you wish to obtain more comprehensive information about L'Oréal, please refer to the public documents registered in France with the Autorité des Marchés Financiers, also available in English on our Internet site www.loreal-finance.com.

This news release may contain some forward-looking statements. Although the Company considers that these statements are based on reasonable hypotheses at the date of publication of this release, they are by their nature subject to risks and uncertainties which could cause actual results to differ materially from those indicated or projected in these statements."

This is a free translation into English of the First quarter 2017 sales news release issued in the French language and is provided solely for the convenience of English speaking readers. In case of discrepancy, the French version prevails.

Contacts at L'Oréal

Individual shareholders and market authorities

Mr Jean Régis CAROF

Tel.: +33 1 47 56 83 02

[email protected]

Financial analysts and Institutional investors

Mrs Françoise LAUVIN

Tel.: +33 1 47 56 86 82

[email protected]

Journalists

Mrs Stephanie CARSON-PARKER

Tel.: +33 1 47 56 76 71

[email protected]

Switchboard

Tel.: +33 1 47 56 70 00

For more information, please contact your bank, broker or financial institution (I.S.I.N. code: FR0000120321), and consult your usual newspapers, and the Internet site for shareholders and investors, www.loreal-finance.com, or the L'Oréal Finance app, alternatively, call +33 1 40 14 80 50.

Appendix

L'Oréal Group sales 2016/2017 (€ million)

| 2016 | 2017 | |

| First quarter: | ||

| Operational Divisions | 6,352.4 | 6,847.8 |

| The Body Shop | 200.1 | 197.2 |

| First quarter total | 6,552.4 | 7,045.0 |

| Second quarter: | ||

| Operational Divisions | 6,143.6 | |

| The Body Shop | 198.5 | |

| Second quarter total | 6,342.2 | |

| First half: | ||

| Operational Divisions | 12,496.0 | |

| The Body Shop | 398.6 | |

| First half total | 12,894.6 | |

| Third quarter: | ||

| Operational Divisions | 5,952.2 | |

| The Body Shop | 200.9 | |

| Third quarter total | 6,153.2 | |

| Nine months: | ||

| Operational Divisions | 18,448.2 | |

| The Body Shop | 599.5 | |

| Nine months total | 19,047.8 | |

| Fourth quarter: | ||

| Operational Divisions | 6,468.1 | |

| The Body Shop | 321.3 | |

| Fourth quarter total | 6,789.3 | |

| Full year: | ||

| Operational Divisions | 24,916.3 | |

| The Body Shop | 920.8 | |

| Full year total | 25,837.1 |